Frequently asked questions & answers

This section is only visible to logged-in ILA Members.

NEW ANSWER!

Discharge of Directors Responsibility and Oversight Role

Does the coverage under a D&O insurance policy depend on the policy’s terms and conditions or on the applicable law?

Answer:

There is no definitive answer to this question, as it depends both on the law governing the insurance policy and on the specific terms of the D&O policy. We recommend first reviewing the policy’s terms and conditions, as they typically provide guidance. If the policy does not address the matter, the applicable law governing the policy should be considered.

If the Depositary Bank and Transfer Agent agreements don’t include specific reporting obligations to the Board of a SIF, on what legal or regulatory basis can the Board still carry out its oversight duties?

Are the Depositary and TA legally required to report to the Board? If so, how often and what should the reports include? Are there any standard KPIs?

And finally, could Board members be held liable if they don’t receive these reports and are therefore unable to properly supervise their service providers?

Answer:

CSSF Circulars16/644 (for depositary) and 22/811 (for UCI administrators) indicate that depositaries and UCI administrators have duties to report, inform and notify the UCI and its IFM / AIFM in respect of events affecting the UCI's life. Both Circulars provide a list of the activities that the depositary / the UCI administrator could perform, and to which the duty to report, inform and notify applies.

It is market practice for depositaries and UCI administrators to issue periodic reports (most commonly observed frequency is quarterly) as well as to notify events or incidents that may affect the UCi's life.

The reporting could be documented in SLAs. In such case the SLAs may also define the KPIs to be reported, that could be adapted to the features and activities of the UCI.

It is also considered good practice for the depositary and the UCI administrator to attend the Board of the UCI when requested, and in general at least once a year.

The IFM / AIFM is also expected to report periodically to the Board and to attend regularly Board meetings.

The IFM / AIFM reporting does not replace those from the depositary / the UCI administrator, the overlap allowing double-checking or discrepancies in the evaluation and treatment of occurrences.

While the Board couldn't be held liable simply for not having received reports, it will have any way to demonstrate how it exercises supervision, and it satisfies its legal obligations in respect of the UCI's activities.

In terms of governance, how do you position the RC 'Responsable de Contrôle'?

Answer:

The appointment of an RC for a Fund is a regulatory requirement and is seen by the competent authorities as an essential element of the organisation of the Fund.

When the RC is not a member of the Fund’s Board, a contract must be concluded between the Fund and the RC or his/her employer defining the services to be covered. In this respect, the RC is a service provider and therefore a third party to the Board / the Fund.

Please also refer to CSSF FAQ (

https://www.cssf.lu/wp-content/uploads/FAQ_Persons_involved-in-AML_CFT_for_a_Luxembourg_Investment_Fund_or_Investment_Fund_Manager.pdf)

on these matters.

In there a standard resignation letter for an iNED?

Answer:

We do not provide standard templates but can note that a Director’s resignation letter should be addressed to the Board of Directors, state the effective date of the resignation and request that discharge be granted to the resigning Director at the next AGM. It is further common to ask the company to proceed with the necessary formalities with the Companies’ Register as well as the supervisory authority (CSSF for example) if applicable. We have also noted that parties may ask confirmation that resigning Director has no outstanding claims against the company in the resignation letter. We might add that external Directors should carefully consider if this is appropriate in the circumstances.

NEW ANSWER! Dispute/Contention issues involving a Director or the Board

What is the correct effective date for fiduciary fees when the appointment and agreement state 1 March 2025, but the client suggests invoicing from July?

Answer:

Fiduciary fees should begin from 1 March 2025, as stated in both the appointment and the agreement. In the absence of any clause linking remuneration to the first Board meeting, the effective date governs when responsibilities and therefore fees start. If the client proposes invoicing from July, it is advisable to review the contractual basis, seek an amicable resolution, and, if necessary, consider legal options. To prevent such disputes, remuneration terms should always be clearly discussed and documented before accepting a mandate.

Why is it important to clearly define the responsibilities of a Conducting Officer separately from those of a Director when the same person holds both roles in a Management Company?

Answer:

It is not uncommon that a Conducting Officer, employed by a Management Company (MC), is also appointed as Executive Director of the same MC.

Employment contracts usually stipulate that the employer can appoint an employee as Director, without additional remuneration being stated in the employment contract for this additional role (an increase in the employee's package might be negotiated between the parties at the time of the appointment).

The appointment as Director does not cause the employment contract to cease and does not alter it.

It is important that the responsibilities of the Conducting Officer are defined in writing (for example in the employment contract, through the MC's organizational manual and in the Terms of Reference of the Management Committee) and are different from the tasks of Director. The responsibilities of a directors are prescribed by law and through the Articles of Association of the Company.

POA for a Luxembourg Branch: Is there an obligation to put in place a aPower of Attorney (“PoA”) in favour of the legal representative of a branch of a Management Company (branch based in EU and ManCo based in Lux) for him to have the authority to execute all documents for the day-to-day activities of the branch?

Answer:

Under Luxembourg law, a branch must notably have a management headed by an agent representing the central administration but who has sufficient power to benefit from a certain degree of operational independence. Powers of delegation would usually be described in the Company’s constitutional documents.

As the branch does not have separate legal personality, a power of attorney from the company to the legal representative is typically required. The power of attorney may take many forms (e.g. separate power of attorney, contract, delegation of authority in the minutes of the relevant governing body’s meeting, power given in the articles of association etc.). Prior to providing such powers, it would be good governance that the management body performs, and documents, a ‘fit and proper’ test on the person to whom powers will be granted.

The power of attorney would typically cover (i) the scope of powers of the representative including any limitations, (ii) remuneration (if any) of the representative, (iii) duration of the delegation, and (iv) liability of the representative. The representative should regularly update the relevant governing body of the company (typically the board of managers/directors) of the activities carried out for and behalf of the branch. As the branch does not have separate legal personality, the company remains liable for all of the branch’s activities.

Note that there may be formalities to comply with to establish a branch in other EU jurisdictions and regulatory requirements to consider on a case-by-case basis.

NEW ANSWER!

Shareholder Issues: Communication/AGM ...

In the absence of a Shareholders Agreement, what legal options do minority shareholders have to influence governance decisions in a private company?

Answer:

It is advisable to check whether the Articles of Association contain any provisions that may assist in the given situation. For private companies with numerous (minority) investors, it is also recommended to establish a Shareholders Agreement that addresses governance matters such as appointments, voting rights, dispute resolution, and more. In the absence of such an Agreement, minority shareholders may find it difficult to enforce any measures.

Are Board and Shareholders’ meetings legally required to be held in French or German, or can they be conducted in English?

Answer:

The language of Board and Shareholders’ meeting, we note there is a legal provision which specifically states that the articles need to be in French or German (with an exception provided for funds) but no reason the AGM etc. needs to be in these languages. The Registre des Societes accepts deposit of Financial Statements in English, and the same applies for CSSF correspondence re: funds.

Company may redact documents in more than one language, indicating which version should prevail in case of doubt.’

Please consider how AGM's of a Luxembourg Societe Anonyme can be validly quorate when a substantial portion (or majority) of its shareholders are subject to economic sanctions and not permitted to travel to Luxembourg to attend an AGM in person.

In such sanction circumstances, are there any extraordinary regimes (for example similar to the Covid exemptions that applied until Dec 2022) to enable a Luxembourg SA to pass its annual accounts and respect the applicable AGM 6-month approval requirements?

The same question applies to how to ensure a valid quorum of EGM's dealing with the replacement of directors.

For example, would it be permissible to change the forum of an AGM to be validly held outside Luxembourg in a jurisdiction where there are no restrictions on the affected shareholders?

Answer:

The questions raised concern the validity of AGMs in certain specific circumstances. These questions are strictly legal and should be addressed to the company’s legal advisors. The ILA Governance Desk is not authorized to and does not provide legal advice. It can therefore not answer the questions submitted.

Is there any specific formality to appoint an independent director during an AGM of a société anonyme, besides the agenda point of board members' (re)election, and the to-be independent director's name (along with the shareholder's candidates) in each shareholder's power of attorney appointing its representative for the meeting ?

Answer:

The agenda of the AGM should indicate the terms of the appointments (for example until the AGM convened to approve the annual accounts for the financial year ending on dd/mm/yy). If the Company is a regulated entity, the appointment would be subject to the Regulator’s non-objection. This applies equally whether or not the director is to be considered as independent.

Conflict of Interest

Does an INED in a Luxembourg fund is a conflict of interest if he/she invest in Fund?

If yes, which mitigation measures should be put in place and are there some specific measures in link with the sector of activity?

Answer:

Article 441-7 of the Companies Act dated 10 August 1915 provides that “any director that has a direct or indirect interest of a financial nature conflicting with that of the company in relation to a transaction falling within the scope of the powers and duties of the board of directors must advise the board thereof and cause a record of his/her statement to be included in the minutes of the meeting. He/she may not take part in the deliberations.

At the next general meeting, before casting any vote on any other resolution, any transactions in which any of the directors may have had an interest conflicting with that of the company shall be reported.

By way of derogation from the first subparagraph, where the company consists of a single director, the transactions entered between the company and its director having an interest conflicting with that of the company shall only be mentioned in the minutes.

Where, because of a conflict of interest, the number of directors required by the articles of association to decide and vote on the relevant matter is not reached, the board of directors may, unless the Articles of association provide otherwise, decide to defer the decision on that matter to the general meeting of shareholders.

The preceding paragraphs shall not apply where the decisions of the board of directors or the sole director relate to standard business carried out under normal conditions.”

The provisions apply to directors of an S.A. - similar provisions exist for other company types such as the S.à r.l. (Article 710-15(6) of the companies act).

A case-by-case analysis is required to determine in each circumstance if there is a direct or indirect financial interest opposite to that of the company and whether the transaction is ordinary business entered into under normal conditions.

For example, the Director holding investments in a fund may not be completely objective & independent, should the Board be called to decide to FV down a security or gate or liquidate a fund.

In terms of market practice, the case referred is generally treated as constituting a potential conflict of interest.

In principle a Board should establish a Conflict-of-Interest policy dealing, inter alia, with such cases.

The policy should cover elements such as

- Is a Director allowed to invest in the Fund on whose Board she/he sits (including the case in which the investment predates the appointment to the Board) ?

- If yes, are there pre-trading rules/processes to be complied with (such as pre-trade clearance, minimum holding periods, restrictions to prevent insider trading, etc)

- The level of disclosure that is deemed appropriate to ensure transparency (recurrent declaration of holdings and trades, disclosure to shareholders)

-

The exercise of the Director’s vote on matters that may directly influence the fund valuation.

Communication/ Relationship with Regulatory bodies

Is there a possibility and is it common practice to request fit and proper assessment by the CSSF prior to the application for a specific mandate?

Answer:

The application for Director on a board of a CSSF-regulated entity requires submission of a number of documents (declaration d’honeur, CV, ID, Casier Judiciaire, list of mandates, etc.). These are usually submitted by a law firm that handles the filing. The CSSF conducts a fit-and-proper test regarding the experience, expertise, and time capacity of the applicant director. The CSSF does not ‘approve’ but confirms ‘no objection’ to the appointment, to be done by the shareholders. Whether or not the applicant has no prior mandates on regulated entities has, to date, not been a consideration of the CSSF, as far as we know.

More and more, in accordance with best practices, we see boards adopt a procedure for admitting new directors. Some may have appointed a nomination committee. It is the board that makes the recommendation to the shareholders (and CSSF) who will/should have conducted their review of eligibility and fit.

Board Governance

In situations where a Board is unable to address all items on the agenda—whether due to time constraints or an overly extensive agenda—what is the standard practice for handling the outstanding items? Are they typically carried forward to the next Board meeting, or can they be addressed via circular resolutions?

Should the minutes explicitly state the reasons for not completing the agenda, along with a list of the items to be deferred?

What best practices should be adopted in such cases to ensure that directors’ responsibilities and liability are not adversely impacted?

Answer:

This is a matter of good governance and best practice. Boards should allocate adequate time to thoughtfully consider the matters before them and ensure there is sufficient opportunity for deliberation and, where necessary, to reach well-informed decisions.

There are various reasons a Board may be unable to complete the agenda. Some topics may require more discussion time than anticipated, certain issues may lead to protracted or contentious debate, or consensus may prove difficult to achieve. These factors can result in time constraints that prevent the Board from addressing all scheduled items.

In such cases, the Board has a few options:

• It may reconvene at a later date to continue the discussion, particularly when matters require further reflection or collective decision-making.

• Alternatively, it may opt to conclude outstanding matters by circular resolution, provided that the company’s articles of association permit this, and that such resolutions are unanimously signed by all board members.

It is important that the minutes clearly record the Board’s decision on how to handle any outstanding agenda items. If the Board decides to reconvene, the minutes should briefly explain the reason (even if simply due to time limitations), and the minutes of the follow-up meeting should reference the prior session.

It should also be noted that, for regulated entities, the use of circular resolutions is generally discouraged by supervisory authorities. In the context of important matters—as implied in the scenario presented—deliberation is typically required, which cannot be adequately achieved through circular resolutions.

The role of the Chairperson (where such a role exists) is especially critical in these situations. The Chair is typically responsible for setting the agenda and should ensure that sufficient time is allocated for each item. During the meeting, the Chair should also manage time effectively, without prematurely cutting off discussion or pressuring the Board into hasty decisions. If reconvening becomes necessary, the Chair may wish to schedule extended time for subsequent meetings to ensure proper handling of deferred matters.

Can a Corporate governance Officer be appointed board member and would he/she be registered on the RCS?

Answer:

The role of CGO is currently not recognised by law. However, ILA is advocating in this sense.

There is no reason why a CGO could not be appointed as a member of the board of a Luxembourg entity by the shareholders.

There is a legal requirement to publish the names of all the members of the board of Luxembourg companies (see notably article 100-13 of the Luxembourg Companies Act dated 15 August 1915, as amended). It is therefore necessary to list the persons acting as members of the Board with the RCS (including the CGO as the case may be)

Are there any regulation/practice that challenges the notion of independence for an independent director?

- 1. According to the number of mandates within the Group (parent company / subsidiaries)

- For example, x mandates within the same Group means that the director is not/no longer considered independent (given the interdependence/ link with the Group)

- 2. Depending on the maximum duration of the mandate within a Company (subsidiary)

- For example, maximum 3 x 3 terms of 6 years or maximum 18 years as a director within this Company

Answer:

- Regardless of a director’s employment (or other) relationship with a group, he/she must act in the best corporate interest of the company.

- There is no “independence test” for directors who sit on the board of unregulated entities.

- The mandate of a director appointed to the board of public limited liability company cannot exceed 6 years – this can be renewed with no upper limit to the amount of times such a mandate can be renewed. There is no requirement to limit the length of the mandate of managers appointed to the board of private limited liability companies or partnerships.

- The above rules do not apply to certain regulated entities (e.g. entities subject to CSSF supervision – see in particular Q&A on Circ. 12/552).

Please also refer to the publication Non-Executive Directors in Luxembourg - NEDs, iNEDs and the concept of independence

https://www.ila.lu/slides/non-executive-directors-in-luxembourg-neds-ineds-and-the-concept-of-independence-2022-1

Auditing and Accounting

Is it appropriate or required to grant discharge to the external auditor (réviseur d’entreprises) during the AGM under Luxembourg company law?

Answer:

In principle, auditors should not be given discharge as they are a service provider to the company (as opposed to the members of the Board). The discharge is foreseen by law (article 461-7 of the amended law of 10 August 1915 on commercial companies) for the members of the Board as well as for the commissaire, but not the réviseur d’entreprises. In practice, it is standard not to include a discharge to the auditor in the AGM and, to our best knowledge, major audit firms in Luxembourg do not request such a discharge.

When acting as a director of a wholly owned private limited company, is it correct that invoicing a director’s fee may not be subject to VAT but could trigger withholding tax, whereas invoicing for general services may be subject to VAT but not withholding tax? How can you tell the difference between director’s fees and service fees? Is there a common way to split them, like using a standard ratio? If service fees need to be reclassified as director’s fees later, does everything (tax filings, records, etc.) need to be updated? And can a client ask for this kind of change after the fact?

Answer:

Based on our understanding, the assumption appears to be generally accurate, though we have seen varying interpretations in different situations.

For example, a service not classified as part of a director's role might include a separate operational or oversight function such as an RC function (“responsable du contrôle”). In line with principles of good governance and transparency, such services should be clearly defined, agreed upon independently, and remunerated accordingly. We therefore recommend seeking professional tax advice.

In terms of how fees are allocated, there are differing practices, but ultimately the distribution should be mutually agreed upon by the relevant parties. We advise that this agreement be clearly documented.

Retrospective changes to classifications or arrangements do not appear advisable or acceptable.

We suggest engaging in a dialogue with the relevant counterparty and ensuring that any discussions and resulting decisions are properly recorded.

Is it market practice to include an indexation clause in a directorship agreement? If yes, would you have any suggestions of how it should be phrased?

Answer:

It is not current practice to subject fees to the cost of living or any other indexation mechanism.The level of fees to be charged is a function of many factors including the size of a company, complexity of operations and regulations, professional risks, inflation, time spent, etc. This is why the engagement/appointment letter (which hopefully exists for every mandate) should clearly specify that fees should be subject to a periodic review taking into account changes in these aforementioned factors.

ILA recommends that the Board’s effectiveness should be assessed through a regular evaluation process. This process includes a review of the Directors’ fees to ensure that they continue to be adequately remunerated.

In summary, we believe there must be a clear undertaking and process for Directors fees to be reviewed in light of changes of numerous factors including inflation. We do not believe the inclusion of an indexation clause is necessary or even helpful.

Would you have a recommendation based on market practice if and how "commission d'apporteur d'affaire" could be invoiced once the mandate is granted?

Answer:

Should such a commission be paid; the governance desk is of the opinion that it is not necessarily a conflict of interest not any dependance issue. They would however recommend disclosing the arrangement to the respective board.

Any other Practical issue involving Directors

Is a registered AIFM (i.e. one below the asset management threshold) required to maintain all the written policies and procedures applicable to an authorized AIFM? Which specific policies are mandatory for a registered AIFM, and which are considered best practices or governance recommendations?

Answer :

There does not appear to be a defined list of 'minimum required' procedures for a registered AIFM. It is the responsibility of the Board of the registered AIFM to determine, based on the nature of the AIFM's activities, which policies and procedures are appropriate to implement. While Article 3 of the Law of 12 July 2013 on AIFMs provides an exemption from certain provisions of the Law for registered AIFMs, it also specifies that such entities remain subject to Articles 50 and 51, which grant the CSSF authority to request information and impose penalties. In light of this, it is advisable for the Board to document the rationale behind its decisions regarding policies and procedures.

What steps should a company take if a director is unable to perform their duties due to illness, and there are no specific contractual provisions addressing sickness?

Answer

:

This is purely a contractual matter and there is no ‘protection’ by law. The initial step would be to verify the contract to determine if there are any provisions regarding sickness. If there are no contractual provisions relating to sickness, we suggest continuing to pay the director at this stage unless the remuneration is a jeton de presence. Depending on the circumstances and the contractual clauses, the company may want to reevaluate its position, suspension of the contract, early termination for non-performance or other contractual remedies may be available. In this scenario, the shareholders would also need to revoke the director’s mandate at the shareholder's meeting - this can be done ad nutum (without cause or reason) in an S.A. and an S.à r.l. (provided that the articles state this for the S.à r.l.).

Are Independant directors of unregulated Luxembourg Companies subjected to the AED?

Answer:

There are two areas for which a Director may need to register with the AED: AML/CFT and VAT. The scope for the duty to register with the AED for VAT purposes is dealt with in the AED’s recent Circular 781-2 available on the AED’s website. The scope of the duty to register with the AED for AML/CFT purposes is dealt with in the Guidelines issued by the Ministry of Justice on Trust and Company Service Providers. The Guidelines contain a list of different situations in which a Director may act. Depending on the applicable situation, the Director will or will not be in scope of the registration duty with the AED

Is a Business Permit required for Independent Directors in Luxembourg? If so, which category should be chosen? and Is CCSS affiliation as an independent necessary, or not?

Answer:

An independent director is not required to obtain a business permit to exercise their mandate.

Newly appointed NED for a Luxembourg company, is there a model invoice for directorship fees?

Answer:

From a best practice perspective, we consider that an invoice should include as minimum requirements.

- Place and date of issuance and date (or period) of the service / supply

- Unique identifier (number or similar) for the invoice

- Supplier’s name, full address, RCS number and company form (if the invoice is issued by a company) and VAT number (if applicable)

- Customer’s name, full address, RCS number and company form (if the recipient is a company) and VAT number (if applicable)

- Nature of the service (that in the case of Director’s fees could also be referenced to the Directorship agreement)

- VAT rate and VATable amount, if applicable, or reference to the article of law if VAT is not applicable to the whole invoice or part of it

When liquidating an SCSp entity which liquidator is the GP of this SCSp entity, do we need other documents than:

- written resolutions of the Partners of the Partnership to dissolve and put the Partnership into voluntary liquidation

- the liquidator report?

Do we need an EGM done by a notary?

For the RCS filing (radiation) do we need to add a mention and if so, can we say that the liquidation has been decided through the liquidator report?

Answer :

The law does not set out a specific procedure for liquidating an SCSp and refers only to the partnership agreement. In practice, the procedure applied for liquidating other company types is often applied. We would suggest to consult the partnership agreement relating the the special limited partnership and seek legal advice if necessary.

Where can Non-Executive Directors in Luxembourg find reliable guidance on VAT changes and their obligations with ADEM and CCSS?

Answer:

It is recommended to contact ADEM and CCSS directly for the most accurate and up-to-date information. ILA has published two informative documents concerning Non-Executive Directors (NEDs) and the new VAT regulation:

Non-Executive Directors in Luxembourg - NEDs, iNEDs and the concept of independence

FAQs

on Directors and VAT - Understanding what has changed

How should a company present directors’ remuneration for approval at the AGM to ensure transparency and facilitate shareholder voting?

Answer:

There are differences in the way remuneration of directors is presented for approval at the AGM of shareholders. In our view, in order for shareholders to vote on Directors’ remuneration, we would recommend that the amounts be clearly disclosed in the AGM convening notice and resolutions. Shareholders should not have to go through tons of pages or embark on an expedition to find the required information. It also avoids suspicion of lack of transparency.

In which cases is a director required to register with the AED, and how do the AML/CFT and VAT obligations affect this requirement?

Answer:

There are basically 2 areas for which a director may need to register with the AED: AML/CFT and VAT. The scope for the duty to register with the AED for VAT purposes is dealt with in the AED’s recent Circular 781-2 available on the AED’s website. The scope of the duty to register with the AED for AML/CFT purposes is dealt with in the Guidelines issued by the Ministry of Justice on Trust and Company Service Providers. The Guidelines contain a list of different situations in which a director may act. Depending on the applicable situation, the Director will or will not be in scope of registration duty with the AED.

Is the withholding tax of 20% director's fee applicable to the invoice of a company providing an INED to a client company? And is the application of the withholding tax subjected to the service provider having multipke activities?

Answer:

The case you have described seems to be common practice in the space of unregulated entities/SPVs and to a much lesser extent for Funds. However, we also note some companies will apply WHT and others not.

In your case, much will depend on the provisions of the tripartite agreement and the substance of such agreement. We would recommend that WHT and subsequent procedures are documented in such agreement. When WHT is included, the (invoiced) company is responsible for paying the WHT within 8 days after payment of the fee, as well as submitting Form 510bis.

We would however recommend that you seek advice from tax and legal counsel as this has both tax and legal implications.

Is the withholding tax applicable if the directorship contract is between the General Partner of a Fund and a service provider, providing this director’s service and not directly between the General Partner of the Fund and the director her/himself?

Answer:

In principle, the remuneration received by the service provider who provides the director’s service constitutes a commercial benefit, and is therefore not subject to withholding tax.

However, if the sole activity of the company providing the director service was the provision of that service, the remuneration would have to be treated as directors’ fees and subject to withholding tax.

This largely depends on the terms of the agreements between the various parties and the substance of those agreements. If in doubt, it is recommended to document the withholding tax and associated procedures be documented in the agreements, and to seek tax and legal advice in this regard.

Is there any specific formality to appoint an independent director during an AGM of a société anonyme, besides the agenda point of board members' (re)election, and the to-be independent director's name (along with the shareholder's candidates) in each shareholder's power of attorney appointing its representative for the meeting ?

Answer:

The agenda of the AGM should indicate the terms of the appointments (for example until the AGM convened to approve the annual accounts for the financial year ending on dd/mm/yy). If the Company is a regulated entity, the appointment would be subject to the Regulator’s non-objection. This applies equally whether or not the director is to be considered as independent.

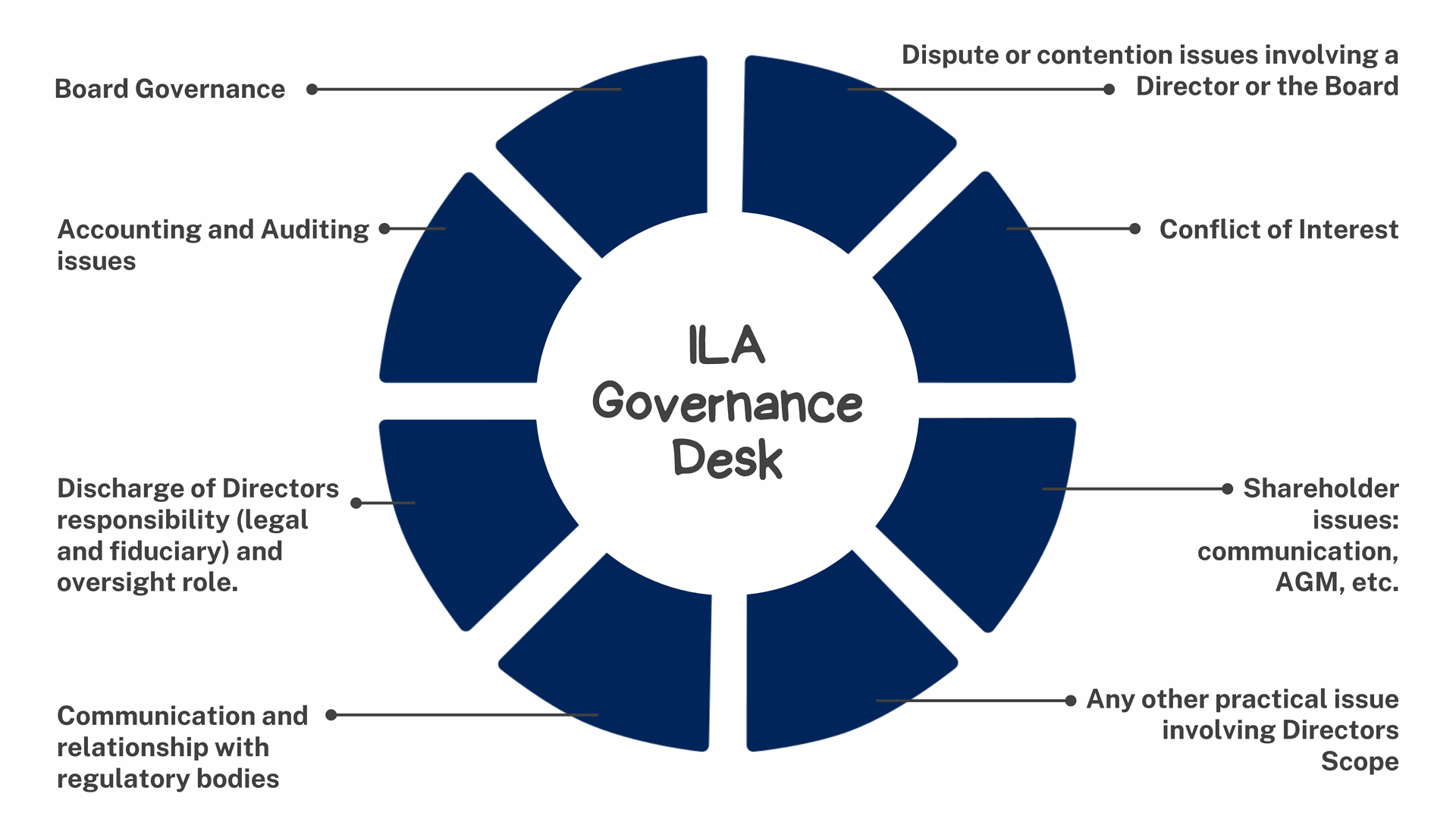

What does it cover?

The Governance Desk covers topics that are relevant to the Board, Directors, or other governance professionals. Questions will be answered from the Director’s or Board’s perspective. Topics to be covered:

Do you want to submit a new question?

Click on the button to access the form, fill it in with your question. You will receive an answer within 2 weeks or more depending on the technicality of the question. After submitting your request you will receive an acknowledgement email with mention of the expected response timeline.

Who is behind the Governance Desk?

The Committee is made up of 5 members with extensive professional experience in governance.

Carine Feipel

Non-Executive Director

"The purpose of the ILA Governance Desk is to provide answers to various Governance questions that ILA’s individual members come across in their roles as Directors or other professionals dealing with Governance topics. I am delighted to join the team of experts who constitute the ILA Governance Desk and who share their experience and knowledge to answer these questions. I am convinced of the added value of this service to ILA’s members and the corporate governance standards in Luxembourg."

John Li

Non-Executive Director

"Sound and Effective Governance: there is more than just the strict application of legal and regulatory rules. The aim of Governance Desk is to provide guidance to ILA members to apply adapted best practices to the Boards of companies they serve. It is about ensuring that due process devoid of any conflict of interest has been applied to arrive at a good decision or outcome."

Aisling Murphy

Lawyer at Stibbe Avocats

"The success of Luxembourg as a jurisdiction is rooted in its ability to champion corporate governance – I’m delighted to be part of this project which will allow ILA members to continue to hone their skills, provide the best service possible as independent directors and be a driver for the continued growth of the Luxembourg financial sector."

Garry Pieters

Non-Executive Director

"A great initiative by ILA, the Governance desk will assist our community on a very practical level, with interpretations and implementation of best practices will hopefully fuel further institutionalisation of good corporate governance."

Enrico Turchi

Non-Executive Director

"Sound governance is a determinant factor driving how well a company is run, protecting the interest of all stakeholders, and mere regulation is not sufficient to guarantee positive outcome. The Governance Desk will draw from the contribution and experience of a diverse range of experts to assist ILA members with practical questions, linking principles and guidelines with pragmatic application."

Disclaimer for The ILA Governance Desk

The information, opinions and views provided on the ILA Governance Desk are provided for informational purposes only and do not, and are not intended to, constitute legal, tax, accounting, regulatory or general advice and shall therefore not be construed as legal, tax, accounting, regulatory or general advice on any subject matter.

Instead, all information, content, and materials available on the ILA Governance Desk are for general informational purposes only. The ILA Governance Desk assumes no liability for any errors or omissions in the information, content and material and does not guarantee the accuracy or completeness of the information, content and material.

Readers of the answers from the ILA Governance Desk should contact their legal advisor to obtain advice with respect to any particular legal matter and should not act or refrain from acting on the basis of this information without first seeking legal advice from their counsel or other professional advice in the relevant jurisdiction.

The opinions expressed by the ILA Governance Desk are those of the desk itself after deliberation amongst its members. They do not represent any individual member’s opinions or the opinions of the organisations they work for.