In an interview with ILA, François Mousel, Managing Partner of PwC Luxembourg and ILA Board Member, talks about how PwC ensures and continuously improves effective corporate governance.

ILA: Mr Mousel, can you describe PWC’s governance structure and how it supports effective governance?

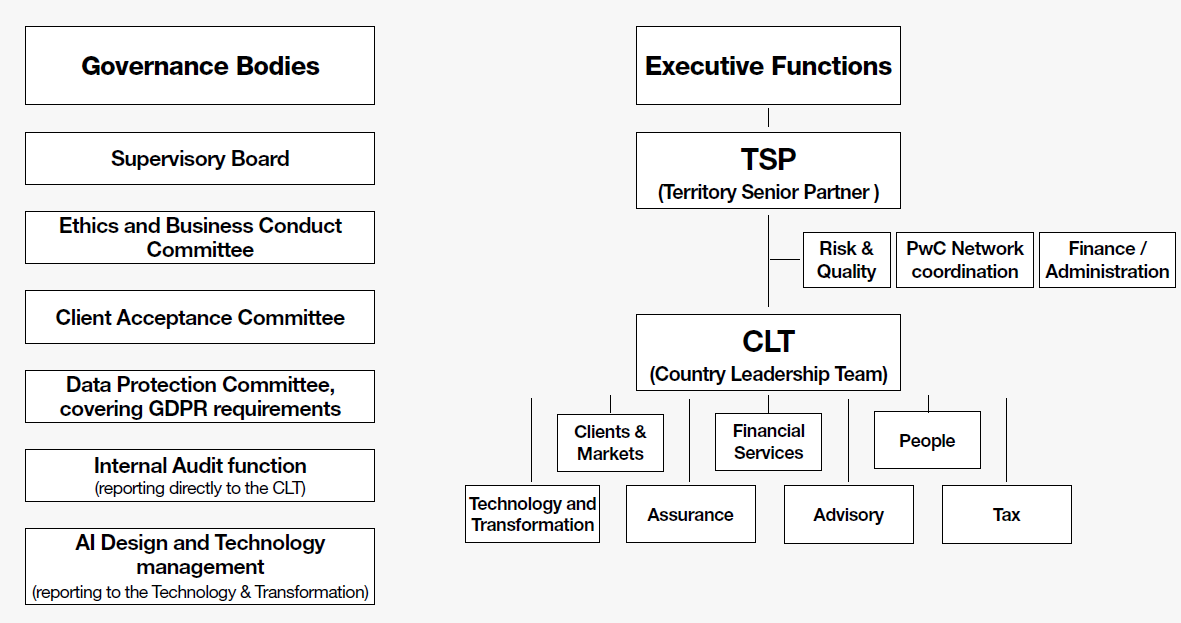

François Mousel: PwC is a societé coopérative owned by the 140+ equity partners of the firm. It does not have a Board of Directors properly speaking, but our governance structure is designed as follows. The firm is managed by a Country Leadership Team (CLT), which is chaired by me, the Territory Senior Partner (TSP). The CLT is a conseil de gérance and each member of the CLT is a gérant of the PwC Société coopérative. The CLT has the overall responsibility for the policies, strategy, and direction of the firm and it integrates the following functions: Clients & Markets, Financial Services, People, Technology & Transformation, Assurance, Advisory and Tax.

Three other key functions are reporting directly to me: Risk & Quality, PwC Network Coordination, and Finance/Administration. The main firm-wide governance and oversight bodies are the Supervisory Board and the Ethics and Business Conduct Committee. We also have other specific Committees around Client Acceptance, Data Protection, and an Internal Audit function. All supporting strong governance. It should also be noted that our leadership cycle is four years (i.e. every four years, there is an election for the TSP, the CLT members and the Supervisory Board), which leads to regular questioning and reshuffling of the leadership positions. The TSP can serve two terms of four years, which all our previous TSPs since the 1998 merger have done, hence also ensuring stability, continuity and long-term actions, all critical objectives for our partnership.

Image courtesy of PwC, Annual Review 2024

I think it is important to note that all the governance functions are mainly taken up by partners who are both shareholders of the firm and working on clients. The conflict of interest that is inherent in other companies is less present here because everybody is a partner and hence also a shareholder of the same firm. So, if the firm does well, all the partners do well, no matter whether or not

they are

members of the CLT or the Supervisory Board or any of the other bodies. In the end, we all share in the same profit pool.

Moreover, for the sake of full transparency and – most importantly - accountability, we have been publishing our Annual Review whose layout mirrors that of the four pillars suggested by the WEF IBC: Principles of Governance, People, Prosperity and Planet, headed directly by me, other CLT members or key leadership functions. PwC’s fiscal year ended on 30 June 2024, so the report referring to that year is now available. As of next year, we will voluntarily do our reporting under the CSRD framework. It should be noted that PwC Luxembourg’s application of CSRD is not legally required, but we see it as a must to be credible in front of our clients and in our commitment towards transparency, long-term thinking and alignment with the intentions of our local and European public stakeholders.

ILA: How has PwC's governance evolved in the last years and how is it going to evolve in the future?

François Mousel: One recent development is that the Risk and Quality function has been significantly strengthened. Before, you had internal audit, OGC, and compliance: all these functions were separate. I have decided to bundle them under a common Risk and Quality function headed by one leader, leading to a much stronger and more integrated function than before.

There is one other major development we are currently reflecting on. This change would entail the inclusion of an independent member in the Supervisory Board to strengthen its composition. Today, the Supervisory Board is composed of partners from the firm, but an independence criterion is already respected, meaning that they cannot have a management function at the same time. Still, they are all members of the same active partnership.

One other aspect that has been the focus for some time now and will remain so is Diversity. I have insisted on including a thorough breakdown of the diversity criteria of the governing bodies in the Annual Review. Now you can have an overview of how our governing bodies are composed by gender, age, seniority in the firm, nationality, lines of service and industry representation. I insist on this because if you analyse your data, you can challenge them and commit to doing better. If you see an over-representation, a discrepancy, you will be more aware of it in the next cycle of the leadership composition. I find this very powerful because, to me, strong governance starts with diverse governance bodies composed of strong and competent members. Every time you see that a scandal is hitting somewhere, very often you realise there is not enough attention paid to the diversity of the governing bodies in the first place.

ILA: How does PwC maintain high standards of ethics and integrity in its operations?

François Mousel: Trust is built based on a culture of transparency, authenticity, walking the talk and a “speak up” approach. Our governing purpose is supported by the solid foundation of our PwC Code of Conduct, our values, and the continuous fostering of an ethical environment. Our internal Ethics and Business Conduct Committee (EBCC) oversees our values and ethical behaviour and is devoted to creating an open and inclusive culture where everyone feels respected, included, and valued while being able to bring their whole self to work.

There is an independent member, in the person of a retired partner, who is involved in the Ethics and Business Conduct committee when we do investigations. We felt this was the best balance between ensuring having someone knowing how we function while at the same time not being anymore actively involved in our partnership and being a very senior person with the necessary balanced view when overseeing or carrying out investigations into unethical behaviours.

Through the Ethics Helpline and a whistleblowing platform, we also provide our workforce with other supportive channels such as a team of confidential counsellors, known as Ethics Counsellors.

Every year we do an annual survey with our entire staff called the Global People Survey, composed of several questions on the people and the ethical dimension. The results of this survey, also communicated at the Global Network level, are publicly available in the Annual Review. If for example, the indicators show that our people perceived that our ethical culture has declined in the past year, we will publicly report on it, including through which concrete actions we intend to improve.

Lastly, our ethical behaviour is also fostered by two mandatory training modules to be taken on an annual basis by the whole workforce: Ethical training and Anti-corruption training.

ILA: How is PwC leveraging technology to improve its governance and operations?

We have created a specific body, the AI Design and Technology Management, which is looking at all the innovations that include an artificial intelligence dimension. In our professional services, there is a very clear framework of what you can and cannot do with AI. We include more and more digital innovations and technology in our services, and we are aware that AI will enhance some of our activities. However, we firmly believe we will remain a people-driven firm. The full review by a human of anything AI-generated will remain a staple. I would say that technology will allow us to concentrate more on where the human has a distinctive impact instead of, say, replacing half of our staff.

ILA: What role does sustainability play in your corporate governance framework?

François Mousel: Sustainability plays an absolutely central role. I always say to my colleagues: that sustainability is not something exotic, it is just long-term thinking. In the end, it just means that when you look at your business, you consider all the matters that could materially impact you and your chance of survival in the long term. The Annual Review is in fact a testimony to that because all those indicators on which we report are those we believe are relevant for our long-term success and relevance. This is also why we have no separate “sustainability body” sitting on the side, but our Corporate Sustainability Office is directly included as part of the CLT Office and all our non-financial KPIs are under the direct responsibility of the CLT or the other key leadership functions. These indicators and hence long-term thinking are directly embedded in everything that our leaders do.

Following our FY23 commitment, this year we conducted our double materiality assessment as defined by the CSRD. This is a key step leading to our first CSRD-compliant report for FY2025.

As mentioned, we decided to voluntarily apply CSRD to our firm and to leverage this regulation as it is a unique opportunity for us to strengthen our corporate sustainability strategy and a way to walk the talk towards our clients, since we deliver sustainability services to our clients.

In FY20 we also made a worldwide commitment to achieve Net-Zero greenhouse gas emissions for FY30, which includes reducing scope 1 and 2 absolute emissions by 50% from the FY19 base, reducing absolute business travel emissions (scope 3) by 50% from the FY19 base and transitioning to 100% renewable electricity. I remain confident this is achievable in absolute terms, even if our business is growing.

ILA: What are the major governance challenges you foresee for the future?

François Mousel: I believe transparency will play an increasing role. We will continue to publicly report on our processes and internal activities. However, there is still room for improvement, because currently our reports are not audited by anyone external. One of the major challenges that I can see for the future is integrating more external views into our governance. This is also linked to the external independent Supervisory Board member that we are considering integrating. I believe this evolution would be a major signal of credibility that we would send to the outside world. Transparency and stakeholder engagement are going to be critical elements going forward because we will build on how stakeholders perceive us and what they think we should be focusing on.

Another main governance challenge is to strike a balance between our main purpose, which is to build trust in society, and the fact that we are a private company with a partnership model which is distributing a profit. So, for me, the critical governance question is how we balance those two aspects: the highest quality public service (in audit for example) while at the same time running a private for-profit organisation. I compare this dilemma to the one of a private hospital for example, which must bridge that tension between doctors wanting to earn their salary while acting at the same time in the best interest of the health of their patients. This is not a statement that all is wrong and the private business model has lots of advantages (dynamism, level of investment and innovation, attractivity for the best talent, etc.); it is rather a tension that you need to be able to manage and strong governance, including external views, is a strong tool to help in managing that tension.

To conclude, I think it is important that an organisation is always questioning itself intentionally around governance. This way, it is easier to spot issues. When you look at the recent governance scandals we had in Luxembourg, we risk going in the wrong direction when trying to fix things. It will not change anything if instead of implementing a four-eyes process, you now require six eyes or eight eyes. It is not a matter of overcomplicating the processes, but asking the right, basic/common-sense governance questions in terms of composition, diversity and skillset of board/management/leadership, rotation of the board/management/leadership members, qualification background, origin/track record and reputation of the board/management/leadership members, 3rd and 4th line of defence functions (like internal audit), speak up channels and strong ethical culture, etc. By checking these thoroughly, you can already avoid 90% of the issues.

ILA: Mr Mousel, thank you for the interview.

François MOUSEL

Managing Partner of PwC Luxembourg