Target audience

This Certification course is

open to ILA Members only with:

- a minimum 2 years of experience as CGO in Luxembourg or

- to "Aspiring CGO" having followed the CGO Bootcamp and with 1 year of experience as CGO in Luxembourg

To guarantee the best possible groups of maximum 25 participants.

Benefits of the training

ILA's new certification includes a comprehensive set of lessons, tools and best practices that today's CGOs must master:

-

Knowledge of the Legal and Regulatory Environment: Gain a comprehensive understanding of key legal and regulatory frameworks, ensuring your organization’s compliance and risk management strategies align with evolving global standards. Engage with practitioners to navigate complex legal landscapes and mitigate governance risks effectively.

-

Advanced Corporate Governance Concepts: Deepen your understanding of complex corporate governance principles and their application to enhance organizational resilience and success.

-

Strategic Insights from Leading Experts: Engage with industry leaders and practitioners to gain strategic advice and solutions for high-level corporate governance challenges.

-

In-depth Analysis of Global Best Practices: Explore and compare corporate governance frameworks and practices on a diversity of topics to improve your organization's corporate governance structure.

-

Enhanced Skills for Board Leadership: Develop advanced skills in board and shareholder management, strategic planning, and effective communication to support and lead stakeholders’ activities.

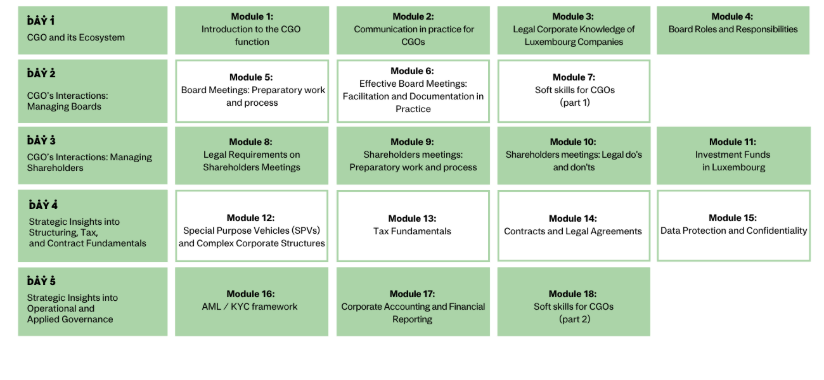

Overview of the programme

Detailed agenda

Day 1 - The CGO and its Ecosystem

Module 1 – Introduction to the CGO function (1h30)

This module covers key principles such as accountability, transparency, fairness, and responsibility are explained, along with the roles and responsibilities of boards, shareholders, committees, and other stakeholders in corporate governance structures. Participants will explore the CGO’s primary role in governance, including key responsibilities like ensuring compliance with legal and regulatory frameworks.

Module 2 – Communication in practice for CGOs (1h45)

This practical session helps participants strengthen clear, concise, and professional communication. Through short exercises and examples, they will learn to adapt their message to different audiences and convey information effectively and confidently.

Module 3 –Legal Corporate Knowledge of Luxembourg Companies

(1h30)

This case study module provides an overview of the common company types in Luxembourg, their incorporation processes, and financing options. It also explains the steps and legal requirements for both voluntary and compulsory liquidation procedures for companies.

Module 4 – Board Roles and Responsibilities

(1h30)

The module delves into the strategic oversight, risk management, and legal obligations of boards, including fiduciary duties and compliance. Participants will also explore the induction, training, and ongoing development processes for board members, with a focus on case study examples.

Day 2 – CGO’s Interactions: Managing Boards

Module 5 – Board Meetings: preparatory work and process (1h15)

This module provides a comprehensive guide to organizing and preparing effective board meetings. It begins with planning the annual meeting calendar, aligning key dates with directors’ availability, and setting clear objectives for each session. Participants will learn how to design well-structured agendas that balance strategic priorities with regulatory and compliance requirements, in close coordination with the chairperson. The module also covers practical aspects such as choosing between physical and virtual formats, managing logistics, and leveraging digital tools to ensure smooth participation and document sharing. Emphasis is placed on gathering and verifying essential materials—such as financial reports and strategic plans—while maintaining confidentiality and secure distribution through board portals. Finally, participants will explore best practices for managing conflicts of interest and ensuring that all preparatory steps meet legal and governance standards.

Module 6 – Effective Board Meetings: facilitation and documentation in practice

(1h15)

This module focuses on best practices for documenting and following up after board meetings, including drafting accurate and compliant minutes, recording decisions, and tracking action items. It also highlights the CGO’s role in maintaining meeting discipline, ensuring productive discussions, and using technology to streamline post-meeting processes.

Module 7 – Soft skills for CGOs (part 1) (1h)

The module emphasizes essential soft skills such as leadership, communication, and influence, which are critical for assisting board meetings as a CGO.

Day 3 – CGO’s Interactions: Managing Shareholders

Module 8 – Legal Requirements on Shareholders Meetings (1h)

This module outlines the statutory obligations for organizing shareholder meetings, distinguishing between Ordinary General Meetings (OGMs) and Extraordinary General Meetings (EGMs), and the legal requirements for shareholder registers and rights. It also covers shares, voting rights, and key topics such as transferability and pledging of shares.

Module 9 – Shareholders meetings: preparatory work and process (30m)

Participants will learn how to prepare compliant meeting notices and draft clear resolutions. The module also covers logistical arrangements for both physical and virtual AGMs, along with ensuring compliance with notice periods, shareholder rights, and proxy voting regulations.

Module 10 – Shareholders meetings: legal do's and don'ts (1h45)

This module provides a practical overview of the legal essentials for organizing shareholders’ meetings. It covers how to manage proxy voting and reporting and apply quorum and majority rules. Participants will also learn best practices for conducting meetings smoothly and maintaining transparent, effective communication with shareholders.

Module 11 – Investment Funds in Luxembourg (1h45)

The module provides an overview of UCITS and AIFs, detailing their key features and differences, along with the roles of fund managers and other key actors like custodians and auditors. Participants will learn about the life cycle of investment funds, from formation to winding up, focusing on compliance, reporting, and governance throughout each phase.

Day 4 – Strategic Insights into Structuring, Tax, and Contract Fundamentals

Module 12 – Special Purpose Vehicles (SPVs) and Complex Corporate Structures (1h45)

Participants will explore the purpose, benefits, and governance of SPVs, focusing on their use in project finance and risk management. The module also covers the complexities of managing multinational corporate structures, including legal and regulatory challenges, governance strategies, and intercompany transactions.

Module 13 – Tax Fundamentals (1h30)

The module covers key tax concepts such as substance requirements for corporate structures and SPVs. It also provides an overview of DAC 6, 7, and 8 regulations and the Anti-Tax Avoidance Directive (ATAD), discussing their impact on corporate tax planning, reporting obligations, and compliance strategies for international structures.

Module 14 – Contracts and Legal Agreements (1h45)

This module provides an overview of key clauses in various contracts, such as confidentiality, indemnity, and termination, while highlighting the CGO’s oversight responsibilities in ensuring compliance. Through case studies, participants will examine agreements such as shareholder agreements, loan agreements, SPAs, NDAs, and directorship agreements, focusing on their critical provisions and management.

Module 15 – Data Protection and Confidentiality (2h30)

This module covers the legal principles of confidentiality, data handling, and e-archiving, focusing on interactions with authorities such as the RBE and RCS. It also highlights GDPR compliance, including key requirements, reporting obligations to CNPD, and a case study on GDPR best practices.

Day 5 – Strategic Insights into Operational and Applied Governance

Module 16 – AML / KYC framework (1h)

Participants will explore the critical components of an effective AML/KYC framework, including Luxembourg-specific AML regulations and policy development. The module also covers setting up compliance committees, monitoring mechanisms, and the roles of the RR and RC, along with reporting obligations and continuous improvement strategies.

Module 17 – Corporate Accounting and Financial Reporting (1h30)

This module introduces the basics of corporate financial statements, explaining their key components such as balance sheets, income statements, and cash flow statements, along with the audit process and stakeholder roles. It also highlights the CGO's role in financial reporting, emphasizing legal, regulatory, and reporting duties related to accounting and taxation.

Module 18 – Soft Skills for CGOs (part 2) (1h45)

The module provides techniques for conflict resolution, negotiation, and facilitating smooth interactions between board members.

Conclusion – Conclusion and exchange with committee members

Online Exams

Online exams will validate the Certification programme.

Cohort # |

Course dates |

Exam dates |

| 17 | 24/11 - 28/11/2025 | From 10/12/2025 (09:00) to 15/12/2025 (18:00) |

| 18 | 09/03 - 13/03/2026 | From 25/03/2026 (09:00) to 30/03/2026 (18:00) |

| 19 | 14/09 - 18/09/2026 | From 23/09/2026 (09:00) to 28/09/2026 (18:00) |

Practical details

Individual training leave

The certification programmes organised by ILA are eligible for individual training leave granted by the Luxembourg Ministry of Education (MENEJ).

Please note that the information provided below can be subject to changes at any time. The website of the MENEJ is to be considered as the official source of information related to the Individual Training Leave. Please refer to it for any question you may have.

What is the Individual Training Leave

Individual training leave is a special type of leave that is granted to allow applicants to:

- attend training courses, and prepare for and sit exams; or

-

engage in any other activity undertaken as part of an eligible training course.

Who is it for

The following people who work in the private sector are eligible for individual training leave:

- employees;

- self-employed workers;

- freelancers.

Individual training leave is paid for:

- by the employer, if the applicant is employed;

- by the State, if the applicant is self-employed.

Deadline

The request must be submitted 2 months before the start of the leave requested.

Documents to be submitted to the MENEJ

Here is the list of the training-related documents that are required, among other things, to apply for training leave from the MENEJ :

- The training registration certificate with the total number of hours (course, exam, etc.). This document is not provided automatically; please send your request by email to [email protected] to obtain it.

- The training programme is included in the ILA Certification Policy CoSec 2024. These details are also included in the registration confirmation emailed to the registrant.

- The invoice for the training which will be sent by email to the participant and/or to the company's contact person once the registration has been confirmed.

- The certificate of attendance of each module will be sent via an automated email from our LMS platform once the module has been attended.

How to submit your request

Please refer to the following websites for further information and submission instructions.

- MEN.lu

-

Guichet.lu